Sustainability as Strategy

At ADMINVIN, sustainability is not an accessory to growth. It is the engine of our strategy, the compass of our decisions, and the legacy we are determined to build. For nearly six decades, we have transformed markets through a philosophy of responsible ambition, proving that profit, purpose, and progress can thrive together. Our objective is uncompromising. We create exceptional returns while shaping a future where opportunity and responsibility advance as one. With over CHF 1 billion in assets under management, operations in 35 countries, and a network of 1,000 visionary professionals, we command a platform capable of driving global impact. This scale gives ADMINVIN the power to lead and the duty to protect. Every investment, from strategy to execution, reflects our commitment to the planet, to people, and to long-term prosperity.

Planet – Protecting the Irreplaceable

We channel capital into projects that cut emissions, conserve resources, and accelerate renewable energy adoption. From high-performance real estate to the meticulous stewardship of our vineyards and fine wine estates, we pursue low-carbon innovation and next-generation efficiency, setting new benchmarks for sustainable development.

People – Empowering Human Potential

ADMINVIN invests in communities, education, and opportunity because enduring wealth is built with people, not just numbers. We champion diversity, inclusion, and ethical partnerships, creating ecosystems where businesses, families, and societies can rise together.

Principles – Governance Without Compromise

Our Swiss heritage anchors a culture of absolute integrity, disciplined risk management, and transparent governance. Every transaction is executed with precision and accountability, safeguarding the trust of our clients, partners, and distinguished family offices around the world. For ADMINVIN, sustainability is both a strategic advantage and a core commitment.

Sustainability as Legacy

By uniting innovation with stewardship, we create investments that are profitable, resilient, and transformative, ensuring that the prosperity we generate today will endure for generations. We don’t just invest. We invest for the world to come. We do not simply manage assets. We create lasting legacies of value and progress.

Our Commitment

As part of ADMINVIN’s focus on client returns, we have a longstanding commitment to sustainability. With a track record of action on sustainability topics that spans almost two decades, we have been at the forefront of driving transformation within our industry and the wider economy through our own operations and across our portfolio.

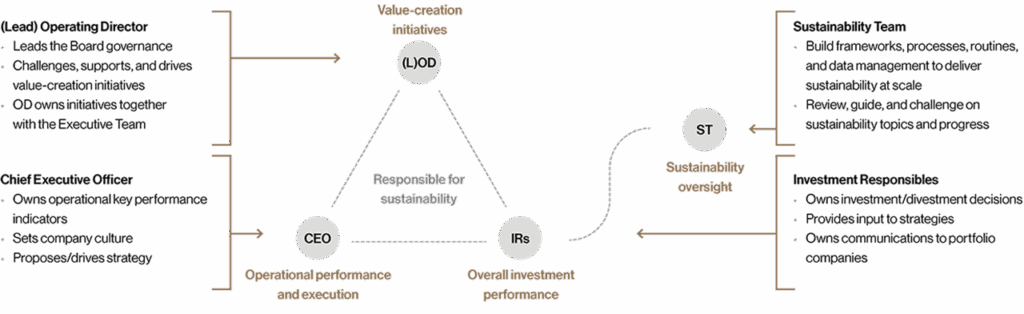

Our Sustainability Governance

Sustainability is fully ingrained in our operations, core committees, and overall corporate governance. Unlike conventional approaches, we forgo a separate Sustainability Committee as our corporate governance model mirrors the dynamic and entrepreneurial spirit that underpins our investment strategies. Just as we govern investments within the parameters of our entrepreneurial governance model, our sustainability governance strategy aligns seamlessly, reinforcing our commitment to holistic and impactful decision-making.

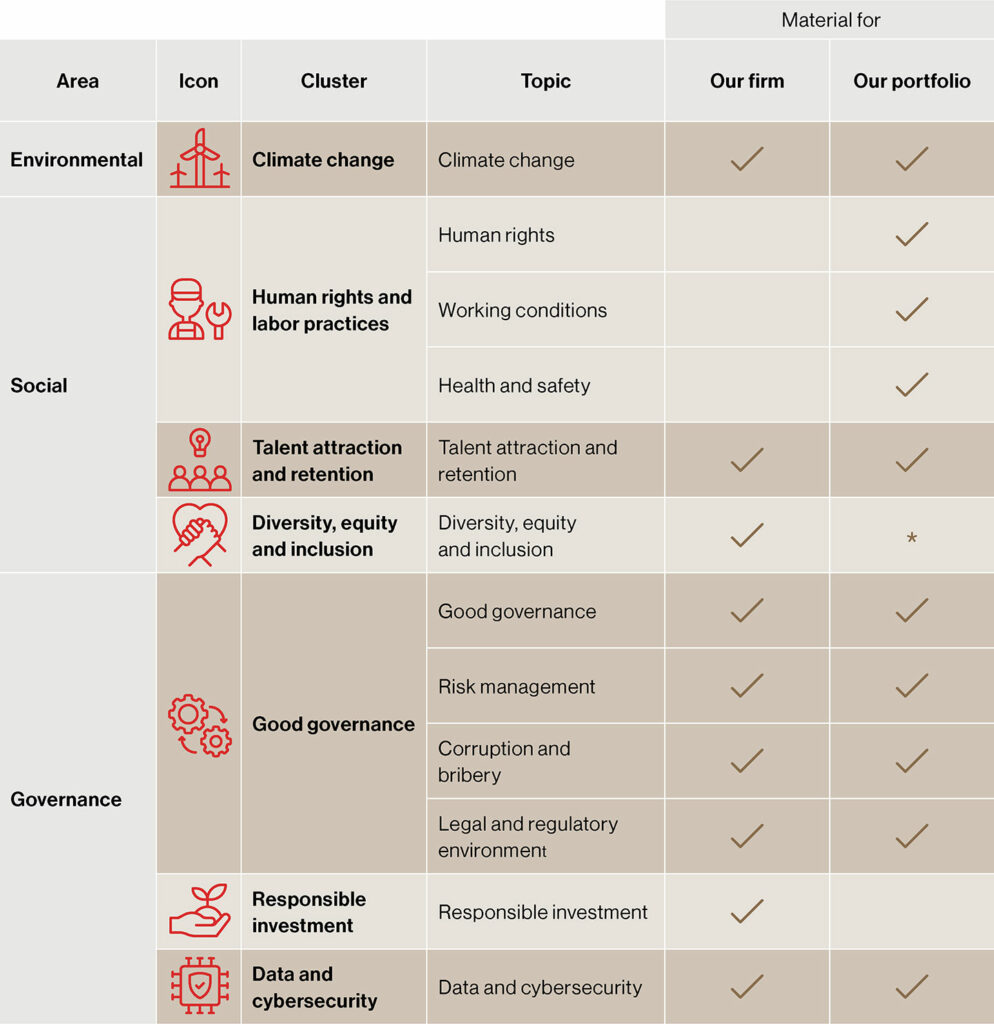

Our Double Materiality Approach

Double materiality assessments (DMA) are innovative tools that companies use to evaluate the impact of sustainability factors on their financial performance and their broader societal and environmental performance (non-financial materiality). Our DMA looked at how these factors can affect the value of our portfolio and how our activities can impact our stakeholders and the wider environment. The assessment helped us reconfirm our Sustainability Strategy topics, and further understand how we can manage the risks and opportunities in our operations and investments.

Embracing materiality, making a difference where it matters most

Our Pathway to Net Zero

Corporate

At Adminvin, we believe that collective investment should go hand in hand with collective responsibility. As a participative investment company rooted in Swiss values, we are committed to integrating sustainability into all our activities. This includes aligning our internal practices with net zero goals and promoting responsible behaviors across all stakeholders.

Our corporate goal:

Achieve net zero by 2030 across all internal operations and company-led initiatives, by reducing emissions (Scope 1, 2, and material Scope 3) and supporting environmentally conscious decision-making.

Portfolio

Our participative model enables individuals and communities to invest in meaningful projects — and we believe these investments should contribute to a sustainable future. In line with Switzerland’s climate commitments and the Net Zero Investment Framework, we are working to ensure that our portfolio evolves toward carbon neutrality, while maintaining long-term value creation and local impact.

Our portfolio goal:

Achieve net zero by 2050 across our investment portfolio, by encouraging sustainable practices in the companies and projects we support.

Our Entrepreneurial Ownership

We approach both our company and our investments with the mindset of co-founders — not just capital providers. As a participative investment platform, we cultivate a collaborative culture where every contributor, whether individual or institutional, plays a clearly defined role in the success of each project.

We lead by example, promoting transparency, shared governance, and long-term sustainability. Our approach encourages our partner companies and projects to adopt structured sustainability practices inspired by our hands-on, community-driven model.

This framework is not just theoretical — it is actively implemented across the projects we support, empowering local governance, encouraging collective responsibility, and reinforcing our mission:

To build value together, responsibly and durably.

« At Adminvin, we believe in long-term value creation through thoughtful ownership. Our goal is to foster sustainable growth by supporting companies with capital stability, strategic insight, and lasting partnership »

Christian Johannes Sager

CEO