Private Wealth

At ADMINVIN, private wealth management is not simply finance. It is the art of stewardship and the science of enduring prosperity.

With over CHF 1 billion in assets under management, a presence in 35 countries, and a network of 1,000 elite professionals, we deliver bespoke strategies that safeguard capital, accelerate growth, and transform success into multi-generational power.

Our mission is clear. We ensure your wealth transcends time, strengthens family heritage, and continues to thrive for generations.

Over 50 years

of expertise in safeguarding and growing private wealth

Bespoke strategies combining Swiss precision and global reach

Trusted by families and entrepreneurs across 35+ countries

Our Private Wealth Philosophy

ADMINVIN blends Swiss precision with global reach to design strategies that balance preservation, performance, and purpose. Every relationship begins with a deep understanding of your vision, lifestyle, and legacy goals, enabling us to craft structures and portfolios that reflect your unique priorities. Our approach emphasizes capital preservation through rigorous risk controls that safeguard wealth across market cycles, while accelerating growth with privileged access to exclusive opportunities in private equity, private credit, real estate, infrastructure, and royalties. We also design tailored structures, from bespoke trusts and holding companies to multi-jurisdictional planning, ensuring seamless wealth transfer across generations. Above all, we operate with absolute discretion, providing uncompromising privacy and security at every stage.

Elite Access to Global Opportunities

Through ADMINVIN, clients gain privileged access to investments rarely available to the public. We offer direct co-investments alongside leading global sponsors, opening doors to exclusive opportunities at the highest level. Our portfolio includes prime real estate and landmark developments in the world’s most coveted markets, as well as private credit solutions engineered for resilient income and capital protection. We also invest in infrastructure and royalty streams that deliver stable, inflation-resistant cash flows. Looking ahead, we back next-generation technologies and innovative start-ups that are shaping the future of global markets, ensuring our clients remain at the forefront of progress.

Family Office Services

For families of significant wealth, ADMINVIN provides a world-class family office platform that serves as a single point of coordination for every aspect of financial and personal affairs. Our bespoke services span governance and succession planning, with frameworks designed to preserve harmony and guide wealth transfer across generations. We offer tax and cross-border structuring through multi-jurisdictional strategies that optimize efficiency and safeguard capital. Philanthropy and impact investing form another pillar of our approach, aligning wealth with personal values and global influence. Beyond finance, our lifestyle and concierge services provide access to elite networks, private aviation, luxury real estate sourcing, and exclusive experiences. Every solution is crafted to protect dynastic wealth while empowering future generations to prosper in an ever-changing world.

Your Legacy, Elevated

Private wealth at ADMINVIN is about more than numbers. It is about power, permanence, and purpose.

Whether preserving a family dynasty, monetizing entrepreneurial success, or creating a new legacy, we deliver the expertise, discretion, and global access that true wealth demands.

We don’t just manage wealth. We safeguard dynasties.

We don’t simply grow capital. We create legacies that endure for centuries.

Building Wealth via Private Markets

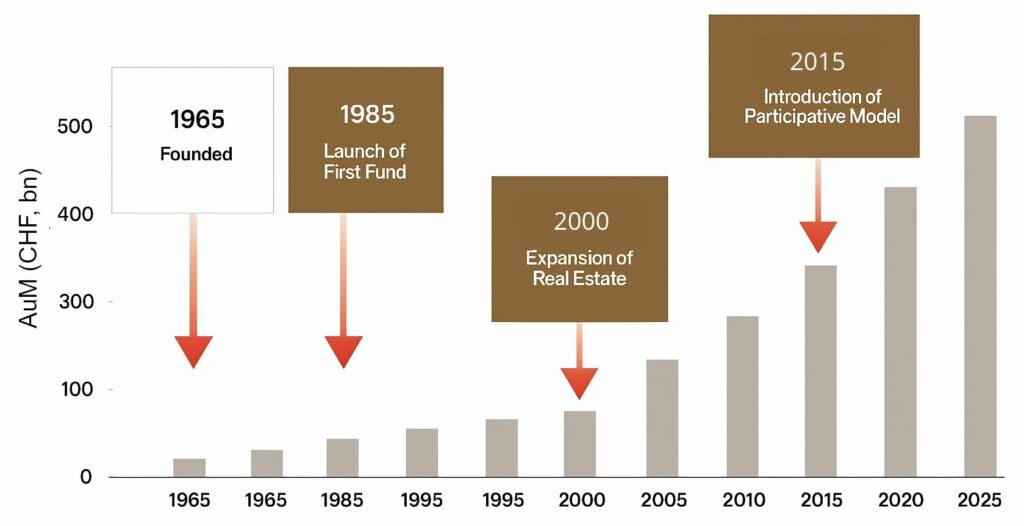

Since 1965, we have built and launched a wide range of innovative private markets investment solutions for individual investors. Our solutions aim to overcome the historical barriers to entry of high minimum commitment amounts and limited liquidity while providing access to the same investment content we offer to institutional investors. Our products are designed to meet the specific goals of individual investors, enabling them to benefit from the attractive return profile and diversification benefits provided by exposure to private markets.

Our Investment Strategies for Private Wealth

Our Track Record in Private Wealth

In more than two decades of creating private markets investment solutions for individual investors, we have had many industry firsts: first private markets evergreen fund, first private equity 1965 Act Fund, first ELTIF, and first private markets funds designed for the world’s three largest defined contribution pension systems. Our long track record of innovation means that our private wealth solutions have been successfully tested across various crises since the turn of the millennium. Our clients benefit from this extensive experience as we prepare to navigate through future macroeconomic events.

Private Wealth milestones throughout the years

« We believe educating advisers and intermediaries is crucial. We make sure our investors have a long-term perspective and understand the specific features of our funds and their value propositions. »

Christian Johannes Sager

CEO